Interest compensated quarterly on the typical day by day stability of financial savings in the course of the quarter around a $five,000 balance and In the event the account is in good standing. Costs in your Key deposit account may perhaps cut down earnings on your own personal savings account.

Funds current market accounts basically operate being a kind of personal savings account, besides They could give increased curiosity costs and incentives the more money you deposit. Additionally, they’re FDIC-insured approximately $250,000 and a fantastic short-expression financial investment choice for All those new to investing or hesitant about investing.

Protected investing apps and sources: Educate your self by downloading Risk-free investing apps and assets or speaking that has a money advisor.

Do I owe tax on my RMD? The whole number of your RMD is taxed as standard money at your own federal money tax price. Point out taxes may additionally apply.

Phase two: The lender will then Exhibit mortgage rates, stipulations. You might then have the choice to accept or decrease the quick-time period mortgage you are actually provided. The loan Won't be is issued till you settle for and digitally indication for the personal loan software and phrases.

Income from the Vault cannot be put in on purchases or cash withdrawals and does not make interest. To obtain and spend The cash you have got put aside, simply transfer it from the Vault back to your card. You may only transfer dollars in or out of your Vault twenty occasions every day. Card harmony boundaries implement.

E-Signature – Usually generally known as an electronic signature this requires a software which binds your signature or A few other mark to the doc. The E-sign bill was handed by The federal government in June 2000 which legalizes this signature.

Remember to evaluation the regulations within your condition To find out more with regard to the implications of not repaying a payday personal loan.

It's also value noting the suitable guidelines are complicated, and that laws can modify rapidly. At the end of the day, you need to execute any strategy incorporating these or identical different types of procedures only immediately after getting sound guidance from a certified tax Skilled in consultation with get more info your retirement plan administrator.

Fact in Lending Act – That is a federal legislation which primarily calls for lenders to be able to speak in confidence to their borrowers the particular cost of the loan. This will include the particular fascination fee as well as the stipulations of this loan in a fairly easy to comprehend fashion.

Caps – The set up Restrict of an sum’s desire amount which can be increased to an adjustable rate mortgage loan financial loan.

Their exchange premiums are extremely aggressive. On some times, they give you a amount which is a lot better than what supplied by the two Tremendous Rich chains.

If you've ever requested oneself, "Just how long will my revenue previous in retirement?", you have arrive at the ideal location — the current retirement withdrawal calculator will assist you to find the proper respond to for sure.

Due to this, we developed the calculator for educational purposes only. Still, in the event you encounter a pertinent disadvantage or encounter any inaccuracy, we are often delighted to obtain valuable opinions and assistance.

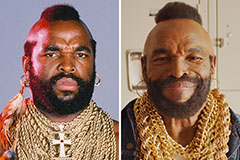

Mr. T Then & Now!

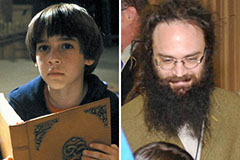

Mr. T Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Elisabeth Shue Then & Now!

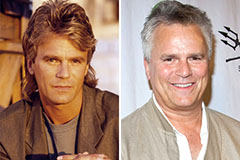

Elisabeth Shue Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!